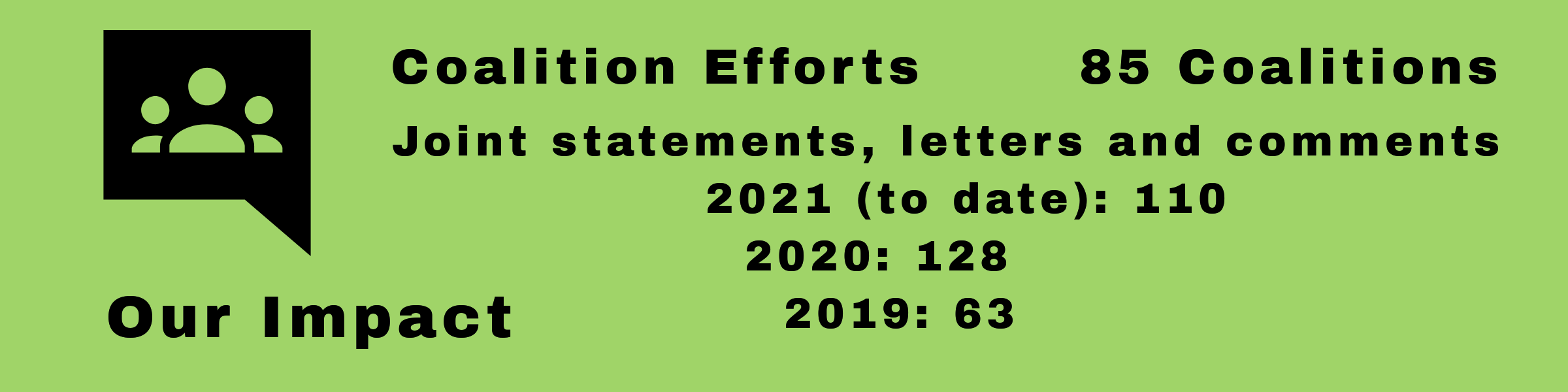

Coalition Efforts

Consumer Action is working on these important issues along with other organizations. If you would like to know more about these issues, please see “More Information” at the end of each article.

Postings

FHFA affordable housing goals laudable, but more can be done for low-income communities

Advocates submit comments to the Federal Housing Finance Agency regarding its efforts to improve strategies that ensure those from low-income communities have better access to affordable housing and homeownership.

Elderly in homes might be deprived the right to sue for abuse and neglect

Dozens of groups in the Fair Arbitration Now Coalition submitted public comments to the Centers for Medicaid and Medicare Services (CMS) opposing its proposal to eliminate protections for seniors who are harmed by mistreatment and legal violations in nursing homes.

The FHFA should make mortgages more accessible to people with LEP

In 2014, approximately 25.3 million individuals, roughly 9 percent of the U.S. population, were considered limited English proficient (LEP). Despite this sizable need and opportunity, the language needs of many current and potential homeowners are left unmet in the mortgage marketplace.

The CFPB champions consumers over Wall Street once again!

The Consumer Financial Protection Bureau (CFPB) finalized a rule to prohibit banks and lenders that break the law from stripping customers of the right to join together and hold them accountable in class action lawsuits. Without the CFPB arbitration rule, bad actors like Wells Fargo will continue to pocket billions in stolen money and, in fact, gain a competitive edge in the marketplace by harming consumers.

Proposed CFPB changes to Home Mortgage Disclosure Act would protect communities

The Consumer Financial Protection Bureau’s proposed changes to the Home Mortgage Disclosure Act (HDMA) would improve the precision of HMDA data definitions and clarify reporting procedures. These changes would enhance the accuracy of HMDA data and its value in assessing whether lenders are meeting community credit needs and in exposing housing and lending discrimination.

The CHOICE Act is WRONG for Americans and the economy

A bill being considered by the House, the Financial CHOICE Act, or more-aptly called “WRONG CHOICE Act” (H.R. 10) would eviscerate post Great Recession safeguards, including most of the Dodd-Frank Wall Street Reform and Consumer Protection Act, putting the U.S. economy and taxpayers in the same perilous position as prior to the financial crisis.

A push for regulatory leadership that is unimpeachably independent

Donald Trump ran on "draining the swamp" of corruption in Washington, DC. Yet, as president, he is working to install a revolving-door government run by representatives of the big businesses our government is supposed to be regulating. In a letter to the Democratic Senate leadership, coalition advocates remind senators that the need for public minded watchdogs has never been greater. The American people deserve voices on a diverse collection of independent agencies, including the Federal Trade Commission, Federal Communications Commission and Securities and Exchange Commission, that are independent of excessive corporate influence.

Mnuchin unfit to serve as Treasury Secretary--Senate should oppose nomination

88 advocacy groups signed a letter to the Senate voicing grave concerns about President Trump’s nominee for Treasury Secretary, former Goldman Sachs partner and OneWest Bank Chairman, Steve Mnuchin. Mnuchin, known as “The Foreclosure King,” oversaw the eviction of nearly 50,000 families from their homes during the foreclosure crisis. The bank’s aggressive foreclosure practices targeted the country’s vulnerable populations—particularly the elderly and widowed. By approving his nomination, the Senate is putting its stamp of approval on his alarming record and choosing to rig the rules for the wealthy rather than protect American families.

Hands off the CFPB!

Advocates penned a very clear response to Delaware’s Senator Tom Carper’s stated interest in exploring changes to Consumer Financial Protection Bureau’s (CFPB) structure: “Back off!” The CFPB has been wildly successful at protecting American consumers and weakening the agency’s oversight would be a grave mistake. The only reason to do so would be to favor the banking and financial industries that jeopardized the world economy and devastated American families less than a decade ago.

Green loans may cause homeowners to see red

PACE (Property Assessed Clean Energy) loans are a special kind of financing sponsored by local governments and used to pay for energy-efficiency improvements, such as solar panels, energy-efficient appliances and windows. The Department of Energy (DOE) provides best practice guidelines for homeowners, but these guidelines don’t adequately educate property owners of the loans’ drawbacks. In a letter to the DOE, Consumer Action joined advocates in urging the agency to better alert consumers of the serious risks associated with taking out the seemingly appealing loans.

Quick Menu

Support Consumer Action

Join Our Email List

Housing Menu

Help Desk

- Help Desk

- Submit Your Complaints

- Frequently Asked Questions

- Links to Consumer Resources

- Consumer Services Guide (CSG)

- Alerts