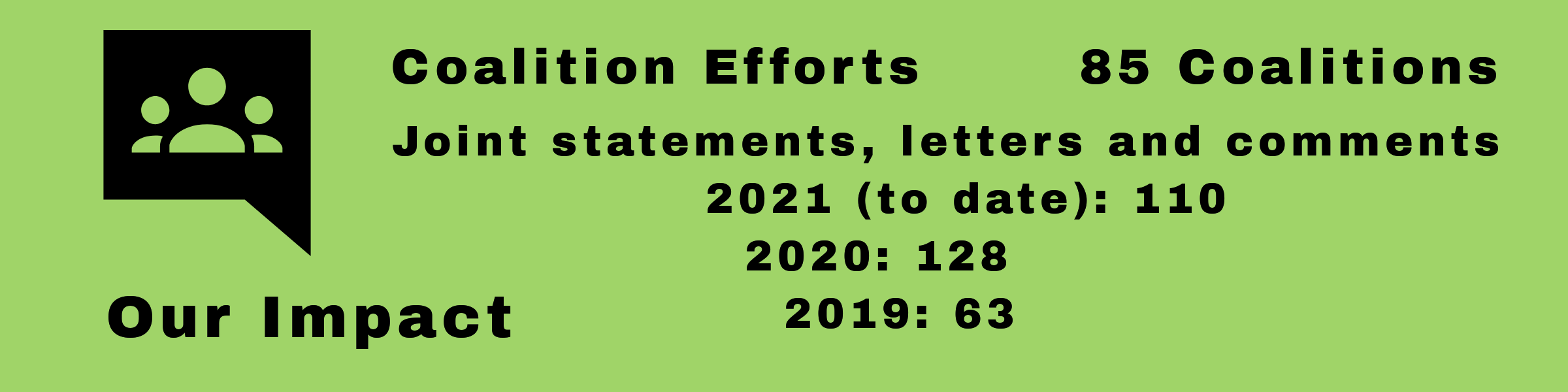

Coalition Efforts

Consumer Action is working on these important issues along with other organizations. If you would like to know more about these issues, please see “More Information” at the end of each article.

Postings

Homeowners could see an increase in fees if mortgage rule is weakened

S. 1577—the “Mortgage Choice Act of 2013” reintroduces some of the higher fees borrowers faced in the lead up to the mortgage crisis; fees that the new mortgage rules were designed to prevent. Specifically, this bill creates a loophole that would allow many more risky, high-cost loans to qualify as Qualified Mortgage (QM) loans by creating exceptions to the points and fees threshold. Consumer Action joins advocates in urging Congress to refrain from weakening the QM standard by rejecting this bill.

Strengthening mortgage reform protections

Consumer Action joined coalition advocates in supporting Sen. Brown's amendment to the Housing Finance bill (Johnson-Crapo) that would require servicers to disclose any new fees, the loan's default status and whether a loan modification application has been submitted prior to transferring servicing duties to a new mortgage servicer.

Proposed Freddie and Fannie reform needs work

Significant changes are needed to improve and strengthen the proposed Johnson-Crapo housing finance reform legislation before it could provide the access to affordable credit guaranteed by Fannie Mae and Freddie Mac. If this bill became law in its current form, it would be a giant step backward for the working class, people of color, Millennials, and other traditionally under-served communities.

Housing counseling helps families in crisis and prevents foreclosures

Consumer Action joined hundreds of housing advocates in urging Congress to increase federally funding for housing counseling in 2015. Housing counseling is a proven, cost-effective tool for Americans facing all sorts of housing challenges, including homeowners facing foreclosure, young families looking to purchase their first home, and seniors considering a reverse mortgage.

Wall Street is about to crash the housing market -- again

In a letter to housing regulators, Consumer Action joins advocates demand "immediate federal intervention" to rebalance the housing market in favor of qualified borrowers who currently can't get affordable mortgage loans. All-cash buyers keep the lending high, making it seemly impossible for first-time homebuyers to enter the market.

Homeowners could face extra tax burden in 2014

The foreclosure crisis is far from over for many homeowners. The expiration of the Mortgage Forgiveness Debt Relief Act means those who were forced to short sell their homes will be subject to higher tax rates by the IRS.

Better records needed for banks selling consumer debt

Unlawful debt buyer practices have caused great harm to Americans and present significant risks for banks' reputations. In a letter to the Office of the Comptroller of the Currency (OCC), Consumer Action and coalition advocates address many of the problems seen with respect to debt collection by debt buyers, and detail the harmful impact on lower-income people and communities.

HUD should extend current discrimination complaint process

Extending the current process of filing housing complaints is important to ensure underserved communities are protected from discriminatory practices.

Confirm Rep. Mel Watt as Director of the FHFA

Civil and human rights groups call for Mel Watt confirmation; cite extensive qualifications, congressional experience, and advocacy for homeowners.

Despite Senate's latest attempt, affordable home financing still needed

On June 25, 2013, Sens. Bob Corker (R-TN) and Mark Warner (D-VA) filed a bipartisan bill to restructure the government’s role in the housing finance market. In response, Consumer Action and the Center for American Progress, along with a broad array of housing and civil rights groups, sent a letter to the senators explaining how the bill falls short in serving America’s families.

Quick Menu

Support Consumer Action

Join Our Email List

Housing Menu

Help Desk

- Help Desk

- Submit Your Complaints

- Frequently Asked Questions

- Links to Consumer Resources

- Consumer Services Guide (CSG)

- Alerts