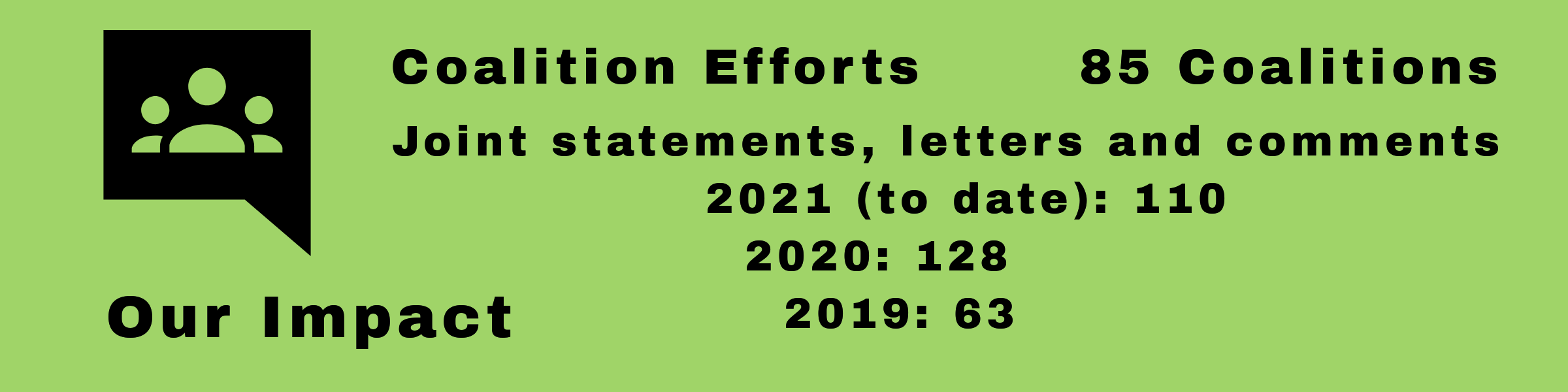

Coalition Efforts

Consumer Action is working on these important issues along with other organizations. If you would like to know more about these issues, please see “More Information” at the end of each article.

Postings

Groups tell temporary CFPB director: Hands off the public database!

71 consumer, civil rights, fair lending, privacy, legal services and community groups called on Acting Director Mick Mulvaney to maintain one of the few tools consumers have to check out a financial services company: the CFPB's consumer complaint database. Mulvaney has threatened to ban public access to the public database.

FHFA announces major upgrades to mortgage application process for LEP borrowers

Consumer Action joined advocates in applauding the Federal Housing Finance Agency (FHFA) in its efforts to improve its affordable housing goals and to reach underserved communities.

Advocates alarmed as HUD considers dropping key mission

The Department of Housing and Urban Development (HUD), responsible for stopping housing discrimination, proposed new language in its mission statement that seemed to encourage consumer “self-sufficiency” over strict enforcement. The move alarmed civil rights, consumer, and fair housing advocates, who worry that the government agency expressly responsible for combating housing discrimination would deemphasize the importance of its mandate under the Fair Housing Act of 1968. The groups joined in a March 8 letter to HUD Secretary Ben Carson asking him to correct this “unfortunate impression.” (It’s been reported that Carson subsequently responded in a HUD memo, saying: “The notion that any new mission statement would reflect a lack of commitment to fair housing is nonsense.”)

Republican tax bill will cost low-to-moderate income taxpayers

Consumer Action and a number of other public interest groups have been active in opposing the Republican tax bill due to its negative impact on low-to-moderate income consumers, particularly homeowners, those looking to become homeowners and those seeking affordable rental housing. The tax bill also undermines community and economic development.

Using homebuyer data to keep lenders honest, stop housing discrimination

Housing and public interest groups are urging the Consumer Financial Protection Bureau to collect and release data that will help policymakers and other invested groups determine if lenders are serving the housing needs of their communities. The data is also invaluable in helping to combat discriminatory home lending practices.

Bill would create weaker protections, costlier loans for many homeowners

Consumer groups sent a letter to Congress opposing a bill that would harm the buyers of manufactured housing (commonly known as mobile homes) by allowing manufactured housing lenders to issue high-cost, dangerous loans.

Legislation lets lenders saddle consumers with predatory home mortgages

Consumer and housing advocates are pushing back against two bad bills in the U.S. House that would undermine existing homebuyer safeguards and allow lenders to issue predatory mortgage loans.

Federal government should not be financing gentrification of low-income neighborhoods

Consumer Action joined legal service offices, housing and consumer credit counseling agencies, base organizing groups and civil rights organizations in expressing strong concerns over the Federal Housing Finance Agency's oversight of Government Sponsored Entities (GSEs) and the Federal Home Loan Bank System enabling the displacement of low-income people and people of color.

Bill would damage credit scores of million of consumers

Consumer Action joined the National Consumer Law Center and other organizations in opposition to HR 435—legislation that would reduce consumers’ control over their own data by preempting state and federal privacy protections, damage the credit scores of millions of consumers with a disproportionate impact on African Americans, and conflict with long-standing state utility regulatory consumer protections.

Do not exempt mortgage lenders from reporting on underserved communities

Groups oppose legislation that would exempt certain lenders from reporting on closed-end mortgage loans if the depository institution originated fewer than 1,000 such loans in each of the two preceding years.

Quick Menu

Support Consumer Action

Join Our Email List

Housing Menu

Help Desk

- Help Desk

- Submit Your Complaints

- Frequently Asked Questions

- Links to Consumer Resources

- Consumer Services Guide (CSG)

- Alerts