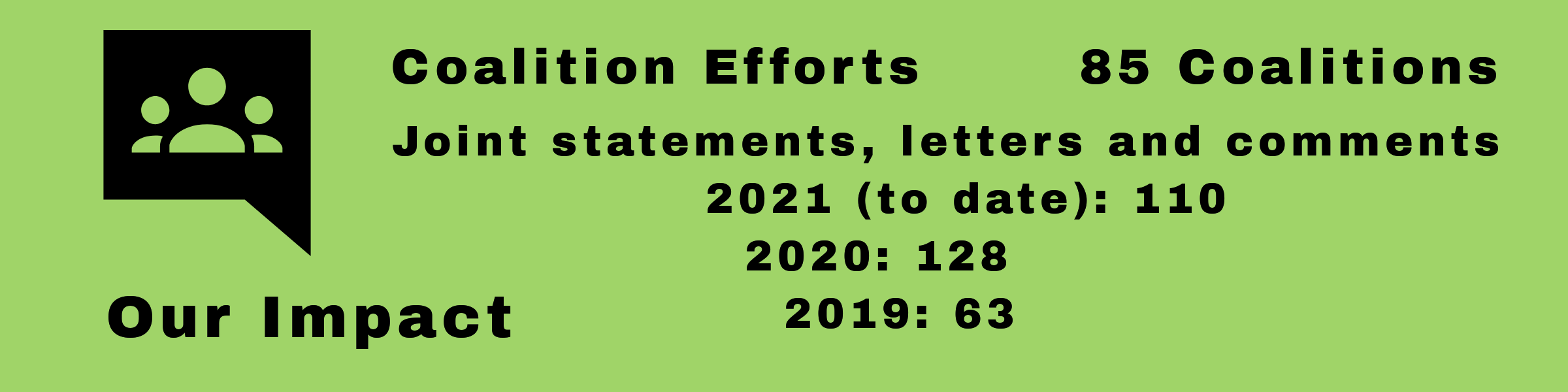

Coalition Efforts

Consumer Action is working on these important issues along with other organizations. If you would like to know more about these issues, please see “More Information” at the end of each article.

Postings

HUD’s attack on core civil rights tool opens the door for discrimination

Consumer Action joined hundreds of organizations in submitting comments in response to a Department of Housing & Urban Development proposed rule that would gut an essential civil rights tool. The Trump administration’s proposal would severely weaken a critical tool for addressing housing discrimination under the Fair Housing Act, called “disparate impact.” This is one of the Trump administration’s most extreme moves to dismantle anti-discrimination laws.

New proposed rule empowers debt collects and their attorneys

In an effort to update the rule that governs debt collectors, the Consumer Financial Protection Bureau released a proposed rule that would make debt collector harassment worse for consumers.

Revamping the CFPB's "Qualified Mortgage" standard could impact credit availability

The Consumer Financial Protection Bureau’s (CFPB) proposed changes to the Qualified Mortgage (QM) definition would allow the government-sponsored enterprise (GSE) patch to sunset in 2021. Advocates warn that terminating the patch could cut off adequate access to mortgage credit to borrowers who are self-employed or more likely to work non-traditional jobs and don’t often conform to traditional QM standards, including borrowers of color and borrowers with student debt.

Relaxing fair lending laws would make it harder to prove discrimination

Consumer Action joined coalition advocates in urging the Consumer Financial Protection Bureau to abandon its recently-proposed rule that would undermine the ability to enforce fair lending laws and prevent discrimination in the mortgage lending market.

Flawed HUD report lets Bank of America off the hook for possible lending violations

Consumer Action joined a group letter to the Department of Housing and Urban Development (HUD) to express serious concerns regarding a recent flawed report that incorrectly concluded that Bank of America complied with HUD rules prior to selling defaulted loans through its Distressed Asset Stabilization Program. The report relied on an inadequate sampling of loans, relied completely on Bank of America’s files, and did not include critical input from U.S. Federal Housing Administration (FHA) insured borrowers.

Consumers need stronger credit reporting protections

Consumer Action joined over 80 advocate organizations in supporting the biggest overhaul of the consumer credit reporting industry in years. House Financial Services Committee Chairwoman Maxine Waters’ introduced the Comprehensive Consumer Credit Reporting Reform Act of 2019—legislation that aims to protect consumer data, prevent identity theft, and ensure the accuracy of consumer credit files.

How the government shutdown puts working families at risk

As the longest federal government shutdown in our nation’s history drags on, advocates raised concern as to how working families could potentially be harmed long after the government reopens its doors. Without a paycheck, federal employees fear losing their homes, consider risky financial loans in lieu of income, tax credits and refunds, and worry about the lasting impact that missed bill payments will have on their credit.

Groups renew call for no poison pill policy riders

Consumer Action is among nearly 50 groups renewing their call to keep spending measures free of poison pill policy riders. Unpopular, unnecessary, partisan provisions that get tacked on in secret have nothing to do with government funding and everything to do with undermining essential programs in order to fill a special interest wish list. Poison pill policy riders also stand in stark contrast to emergency needs that are going unmet, like guarding consumers from scams and corporate wrongdoing, securing our air, land, water and wildlife, and defending our campaign finance and election systems.

Advocates warn that HUD’s disaster relief program is too limited in scope

In an official letter to the U.S. Department of Housing and Urban Development (HUD), advocates urge HUD to improve its efforts to expedite the process for borrowers in disaster areas to access loss mitigation. While a good start, The Disaster Standalone Partial Claim program does not do enough for borrowers in disaster areas that have not yet fully recovered, and the program includes vague and unnecessary eligibility requirements that will impose unnecessary barriers to mortgage relief.

The CFPB's consumer education programs must be protected

In open comments to the agency, advocates urged the Consumer Financial Protection Bureau (CFPB) to keep its education programs, just one component in its set of consumer protection tools. Other Bureau responsibilities, including its enforcement and rulemaking authority, should also be utilized to fully protect consumers in accordance with the CFPB’s mission.

Quick Menu

Support Consumer Action

Join Our Email List

Housing Menu

Help Desk

- Help Desk

- Submit Your Complaints

- Frequently Asked Questions

- Links to Consumer Resources

- Consumer Services Guide (CSG)

- Alerts