Released: March 16, 2020

Saving for retirement (Spring 2020)

Table of Contents

- Retirement savings: a looming crisis, or a work in progress?

- SECURE Act takes aim at retirement insecurity

- Early retirement calculations key to preparedness

- Delaying Social Security payments might make sense

- All about automatic enrollment plans

- Savings options for the self-employed

- Highs and lows of employer-sponsored plans

- Avoid these retirement savings pitfalls

- About Consumer Action

Retirement savings: a looming crisis, or a work in progress?

By Ruth Susswein

Alarmingly, the typical working American has no retirement savings, according to 2018 data from the non-profit research group National Institute on Retirement Security (NIRS). This would indicate that too many people are expecting Social Security to support them in retirement. Social Security was never intended to be a consumer’s sole source of retirement income.

In its most recent report, in January, NIRS found that 40% of older Americans are relying solely on Social Security income in retirement.

The results of Consumer Action’s recent online retirement savings survey were far more encouraging. The vast majority of consumers (82%) who participated said they have saved for retirement. Close to two-thirds (62.4%) report having saved funds through an employer-sponsored retirement plan, such as a 401(k), 403(b), 457 Plan, SEP-IRA, SIMPLE IRA, etc.

Half (50.5%) said they have savings in an individual retirement account (IRA), and more than one-third (38%) report having retirement funds in a pension plan. While pension plans are a rapidly dwindling benefit, 40% of survey respondents said that they are between the ages of 61 and 70, which might account for the large percentage of pension plan beneficiaries.

Among workers who have accumulated savings in retirement accounts, NIRS says the typical balance is a modest $40,000. While Consumer Action did not ask people how much they’ve saved, when asked about their confidence level, based on their retirement savings so far and their plans for the future, 53.5% of those surveyed said they feel that they will have enough retirement savings. Fewer than half (46.5%) of Consumer Action survey respondents predicted they will not have enough. The non-profit Employee Benefit Research Institute (EBRI) concurs. Its 2019 survey said that about two-thirds of workers are not only saving for retirement, but are confident that they will be able to “live comfortably” in retirement.

Whether consumers are accurately estimating their retirement savings needs is unclear. Recent surveys point to a level of consumer overconfidence. Alicia Munnell, director of the Center for Retirement Research at Boston College, warns that people with 401(k) savings “may suffer from a ‘wealth illusion’”—not recognizing that their savings will not last throughout retirement. Nationwide Insurance found that future retirees overestimate what they’ll receive in monthly Social Security payments.

Social Security benefits replace only about “40 percent of pre-retirement income,” according to the NIRS 2020 report. With ever-increasing healthcare costs and lengthier lifespans, many financial planners recommend that retirees plan on having enough savings to maintain at least 70 percent of their income once retired. For help with determining how much you’ll need to comfortably retire, see Early retirement calculations key to preparedness.

Averting a retirement crisis

Efforts are being made nationally and in some states to help prevent those headed toward retirement from falling into financial crisis. At the tail end of 2019, Congress passed the SECURE (Setting Every Community Up for Retirement Enhancement) Act, which encourages small businesses to automatically enroll employees in the company retirement savings plan and allows part-time employees to participate in their employer's 401(k) plan. This law also makes it easier for employers to join multiple-employer plans to save money on administrative costs. For details on the SECURE Act, click here.

A growing number of states are implementing programs that require small to mid-size employers without their own retirement plans to facilitate employee participation in their state’s automated savings plan. California, Connecticut, Illinois, Maryland, New Jersey and Oregon have these mandated programs. Typically, employee savings are deposited in Roth IRAs, which offer tax-free withdrawals in retirement. Employers set aside 3% to 5% of employees’ monthly salary. Employees can choose to opt out of the automatic retirement savings plans. For details on these state plans, see Auto-enrollment plans.

Obstacles to saving

We do not always choose our retirement age. Some people are forced to retire earlier than they projected because of health issues or unexpected job loss. According to the Employee Benefit Research Institute, about 43% of retirees retire earlier than they expected.

Many of the respondents in Consumer Action’s survey mentioned in open-ended questions that they were forced to retire early due to a medical problem or disability. They lamented that medical issues have affected their ability to save for retirement. Many said they worry about unexpected medical costs in their future. Benefits specialists from Fidelity warn that covering healthcare costs is one of the “most significant, yet unpredictable, aspects of retirement planning.”

Others told Consumer Action that saving for retirement has had to take a back seat to funding college tuition, paying for home repairs or helping support adult children, grandchildren and parents. When asked about their obstacles to saving for retirement, nearly half (45%) told Consumer Action that they don’t earn enough to save. Another 32% said they have non-mortgage debt that takes precedence; 15% attribute that debt to student loans. Still others admit to not prioritizing retirement saving or to starting too late in life.

Stretching retirement dollars

In EBRI’s 2019 survey, eight in 10 workers estimated that they will earn money during retirement; however, only 28% of retirees actually do.

You may choose to delay drawing on your Social Security retirement payments to increase the amount you’ll receive. If you delay claiming benefits until after your full retirement age (66 or 67, depending on the year you were born), you can receive a significantly higher benefit. Those who reach full retirement age at 67 would get an extra 24% each month for the rest of their life if they waited until 70 to claim their Social Security benefits.

While many maintain that delaying Social Security payments is the right approach for most people, some argue that taking funds at the earliest possible age (currently 62) is best for those with health issues or other concerns. For more on this issue, see our article about the impact of delaying when you take your Social Security benefits.

From 2020 on, Social Security will pay out more in benefits than it will take in. According to the Social Security Board of Trustees’ predictions, the Social Security trust fund reserves will run out of money by 2035. But before you panic, remember that that means Social Security will rely on interest earned and funds collected in payroll taxes from those who are still working. Without any changes to the system, estimates are that those dollars will amount to three-quarters of the payment recipients had been expecting, or $750 instead of $1,000. Lawmakers may choose to close the payment gap with higher payroll taxes, increases in the amount of income taxed to fund Social Security, increases in the retirement age or cuts to monthly benefits.

While saving for retirement is not on many younger people’s minds, most advisers recommend that workers start saving when they enter the workforce. From goal-setting to building wealth, NerdWallet offers a multi-step guide to help you prepare for an affordable retirement.

SECURE Act takes aim at retirement insecurity

By Monica Steinisch

The bipartisan Setting Every Community Up for Retirement Enhancement (SECURE) Act is an effort to prop up Americans’ financial reserves through changes to retirement plan regulations. The goal of the recently passed legislation (effective January 2020) is to avert what is widely seen as an imminent retirement savings crisis.

Elements of the SECURE Act will touch most retirement savers, though its ultimate impact on individuals’ bottom line might be modest. Here’s a rundown of the law’s most noteworthy components.

To increase employee access to a workplace retirement plan:

- The SECURE Act encourages small businesses to make a retirement plan available to their workers by increasing the tax credit to up to $5,000 for plan start-up costs.

- Many of the country’s 27 million long-term part-time workers will now be able to participate in their employer’s retirement plan because the new law allows part-timers to qualify for coverage with one year of 1,000 hours worked or three consecutive years of at least 500 hours. (Hours worked before Jan. 1, 2021, are not counted toward satisfying the requirements for part-time employee plan participation.)

- The law makes it easier for small businesses to participate in a pooled retirement plan of unrelated employers. These multiple-employer plans (MEP) make offering a retirement plan more attractive for small businesses because they remove the administrative burden and fiduciary responsibility associated with sponsoring their own plans. (MEPs will take effect January 2021.)

To increase employee participation in a workplace retirement plan:

- Statistics show that employees are more likely to continue participating in a retirement plan if they are automatically enrolled. The SECURE Act encourages auto-enrollment by providing a $500 tax credit for three years to businesses that add auto-enrollment of new hires. The law also increases the savings cap on auto-enrollment plans from 10% to 15% of employee pay. (Employees can opt out of the retirement plan or the increase.)

To augment Social Security income:

- Despite many financial counselors’ misgivings about the value of insurance annuities for retirement savings, the new law allows employers to offer annuities as a retirement investment option. An annuity, when purchased within a workplace retirement savings plan, allows participants to invest their savings with an insurance company in exchange for a steady stream of payments to the saver at some point in the future. Be aware that annuities have many detractors who argue that the contracts can be complex and fee-laden. Critics see this as more of a win for the insurance companies that offer annuities than for savers.

To address increased longevity:

- U.S. life expectancy is around seven years longer today than it was when IRAs were established in 1974. A longer life means more years of retirement to fund, so savers can now contribute to a traditional IRA indefinitely (the 70½ age limit has been eliminated), as long as they are still working. They also can allow their savings to grow untouched a bit longer. Withdrawals (called required minimum distributions) are now mandated at age 72 instead of at 70½.

To avoid premature depletion of retirement funds:

- Employees who borrow against their 401(k) balance can no longer access those loans through a credit or debit card. (Some employers had been allowing employees to link a credit or debit card to their 401(k) accounts as a way of borrowing from the retirement account.)

Taken as a whole, the SECURE Act offers some promise for improving retirement preparedness on a broad scale. Skeptics, however, say it will take much more for a real turnaround, including addressing the issues of income inequality (which affects savings) and overwhelming student loan debt (which redirects dollars from retirement savings).

To learn more about the SECURE Act, visit Investopedia.com and MarketWatch.com.

Early retirement calculations key to preparedness

By Monica Steinisch

With so many variables factoring into any retirement plan, it’s easy to miscalculate. To avoid falling short, estimate now what you’ll need and what you’ll have.

Retirement spending

The first number to determine is what you’ll spend in retirement—in other words, your annual income needed in retirement. Experts recommend that you plan on needing 70% or 80% of your pre-retirement income.

Personalize this estimate by factoring in your particular circumstances and expectations. For example, if your pre-retirement income is not particularly high, you rent your home, you anticipate significant medical bills, or you plan to travel extensively, then you might want to plan to replace 90% of your salary.

On the other hand, if you end your career with a relatively high income, plan to pay off your mortgage before retirement, are in good health, have been saving a significant portion of your income toward retirement, and generally expect monthly expenses to go down rather than up, then 60% might be enough. NewRetirement.com offers “9 Tips for Predicting Your Retirement Expenses.”

A few things to consider:

- If you retire before 65 (when Medicare begins), individual health insurance would be a major monthly cost, and some healthcare costs will continue even after you begin Medicare.

- Retirement typically puts you in a lower tax bracket, but that doesn’t mean you won’t pay some taxes. Withdrawals from a traditional IRA are taxable, and around half of Social Security recipients pay taxes on a portion of their benefits. Learn about this and 10 other overlooked retirement expenses, such as home renovations and adult children, at MoneyTalksNews.com.

- Inflation will cause all your non-fixed expenses to increase over time—2% per year is a reasonable assumption.

Now add up all the income you expect to receive annually from sources other than savings. This will include Social Security for anyone who qualifies, and might include things like a pension, rental income, an annuity, reverse mortgage proceeds or part-time work.

Subtract your expected annual income from your estimated annual expenses to determine how much of your yearly spending will need to be funded through retirement savings.

Calculating and managing Social Security benefits: A 2019 retirement planning survey by Nationwide Insurance revealed that future retirees overestimate how much they will get from Social Security, and are mistaken about the age at which they will be eligible for full benefits. Find out what your full retirement age is at the Social Security Administration website. While you’re there, get an estimate of your benefits. Estimates are based on your Social Security earnings record so far, and can change due to increases or decreases in your earnings, cost of living adjustments, and other factors.

Savings target

One rule of thumb is to multiply the annual amount you’ll need to withdraw from savings by 25 to determine how big your retirement nest egg should be. As an example, if you predict you’ll need $40,000 per year from savings to supplement Social Security and other income, you would need to accumulate $1 million ($40,000 x 25) by the time you stop working. (This calculation assumes a 4% annual return on your investments after inflation.) For a more conservative plan, increase the multiplier from 25 to as much as 30 or more. Learn more about this calculation, and learn about a guideline for retirement savings withdrawals, at The Balance.

Once you have your savings goal, use an online calculator to plug in multiple variables—current retirement savings, goal amount, expected rate of return, etc.—to determine how much you need to save each month or year. Do an online search for “retirement savings calculator.” When entering personal financial information online, use a private browser window to ensure that your data will not be stored.

These tips will make it easier to achieve your savings goal:

- The earlier you start saving, the less you’ll have to save per month during your working years. For example, to accumulate $1 million by age 67, you’d have to sock away $613 per month if you started saving at age 30 (assuming a 6% rate of return). If you started saving at age 40, you’d have to put away $1,239.85 per month to achieve the same $1 million. (Learn about the power of compounding.)

- You must invest, not just save. For example, you’d have to save $995 per month to accumulate $1 million in 30 years at a 6% annual rate of return, which based on past performance may be a reasonable return to expect for long-term stock mutual fund investors. If you instead put your retirement dollars in a high-yield savings account (at 2%), you’d have to save $2,029 per month to accumulate the same amount.

- Be sure you’re getting investment advice from a fiduciary—someone who works in your best interest—and know the fees you are being charged each year for that advice.

- Take full advantage of a workplace retirement plan where you receive an employer match. See how important it is to maximize your employer’s contributions.

- Use tools like AARP’s tax calculator to understand the impact of taxes on your savings goals.

Delaying Social Security payments might make sense

By Alegra Howard

Delaying Social Security payments until age 70 proves to be one of the most valuable retirement strategies for most middle-income workers.

Your Social Security payout is based on the year you were born, your lifetime earnings and the age at which you start claiming the benefit. You may start claiming benefits as early as age 62, but doing so results in the smallest payout. You can earn higher retirement benefits each month that you wait to collect beyond your full retirement age—that’s the year you’re eligible to receive 100% of your Social Security benefit, and is currently between 66 and 67, depending on when you were born. This increases your monthly payment by two-thirds of 1% for each month that you wait—or 8% a year. This means a retiree will receive the largest payout by waiting until age 70 to draw Social Security benefits. There is no benefit to delaying beyond age 70. (You can calculate the effect of an early or late retirement on the Social Security Administration’s website.)

62 vs. 70

The Stanford Center on Longevity and the Society of Actuaries analyzed 292 retirement strategies and found that if a wage earner retired at age 70 instead of age 62, the additional savings accumulated (through delayed Social Security benefits and continued retirement contributions) would nearly double over those eight years. (Click here for the study.)

Here’s what researchers found about deferring Social Security payments:

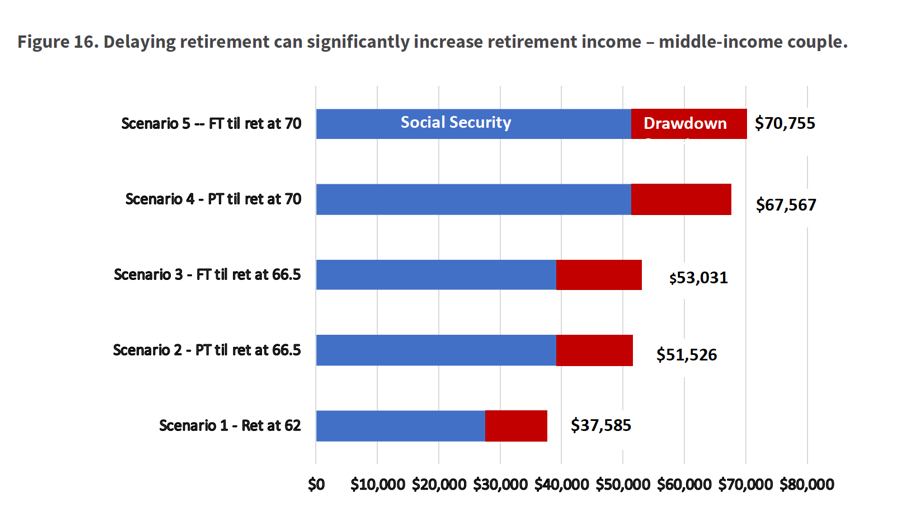

- A couple with an annual household income of $100,000 retiring completely at age 62 would receive a $37,585 annual payout;

- Working part-time until retiring at age 66.5 results in a $51,526 annual payout;

- Working full-time until retiring at age 66.5 results in $53,031 annually;

- Working part-time until retiring at age 70 results in $67,567 annually; and,

- Working full-time until retiring at age 70 results in $70,755 annually.

If waiting until you’re 70 to retire is not a viable option for you, consider working part-time to make just enough to cover living expenses until age 70. Also consider reducing your living expenses during the delay period. Another option is to create a “bridge fund” by drawing on your retirement savings until you reach 70.

Of course, there are drawbacks to waiting until age 70 to take your benefits. With Social Security’s funding deficiencies, benefits could be reduced if Congress doesn’t act. The 2019 Social Security Trustees Report estimates that the Social Security Trust Fund will be depleted by 2035 if nothing is done. If that’s the case, Social Security benefits could be reduced by more than 20%, and those eligible to receive Social Security payments might consider cashing in sooner.

Another consideration is spousal benefits: Your financial situation may require that you file for Social Security at full retirement age so that your spouse can file sooner and receive benefits under your account. (The highest spousal benefit is half the benefit you’re entitled to at your full retirement age.)

Every year past 62 (until 70) that you wait to draw Social Security benefits increases your Social Security payout, setting you up for a more comfortable financial scenario in your remaining years.

All about automatic enrollment plans

By Lauren Hall

Workplace retirement plans are one of the best ways for employees to continuously contribute to their long-term investments without having to think about where their money goes every month. With an automatic enrollment plan, even those who know nothing about retirement savings can benefit.

People who aren’t inclined to save money may stand to gain the most from an auto-enrollment plan since they are enrolled by default. With a “simplified” plan, employees do not have to choose from among many investment options. This is a big benefit, not only for those who haven’t been taught to save or invest for retirement (or who don’t value doing so), but also for those who have trouble making choices or are intimidated by investing. Employees do not have to stay in an automatic retirement savings plan; they can choose to opt out.

The data shows that automatic enrollment increases both participation in retirement savings and actual rates of saving. According to a Merrill Lynch study, “[retirement] plans with auto-enrollment had 32% more participants, and those with an auto-escalation feature had 46% more participants increasing their contributions.”

Of course, auto-enrollment is not without its critics. For instance, it may not increase an employee’s overall retirement savings if the deposits are too low, the plan is too risky, or the savings contributions don’t rise with the cost of living. With these factors, auto-enrollment may give employees a false sense of confidence, prompting them to feel that their modest investments in these plans are all that’s needed for a comfortable retirement.

States’ automatic enrollment plans

States are increasingly adopting auto-enrollment programs and mandating that businesses without their own retirement plans take part in them. State auto-enrollment plans exist as Roth IRAs, meaning deposits are taxed going in and principal and earnings are tax-free when withdrawn.

According to Georgetown University’s Center for Retirement Initiatives (CRI), there are now 11 auto-enrollment retirement savings programs for private-sector workers. Of these, six states and one city require small employers who don’t offer retirement plans to participate: California, Connecticut, Illinois, Maryland, New Jersey, Oregon and the city of Seattle.

None of these employer-facilitated auto-enrollment plans permits employer contributions, except for, in some cases, California’s CalSavers program. Savings are funded by automatic employee deposits through payroll deductions. In an emergency, employees can access the full amount of their CalSavers contributions, and, in some cases, the earnings too. Other state plans also allow for withdrawals for emergencies, since they are Roth IRAs. The city of Seattle is the only plan that does not permit emergency withdrawals.

In most of the states, the default contribution rate is 5%. (In Connecticut and New Jersey the rate is 3%.) Oregon—where the default contribution rate is the standard 5%—also enjoys the highest annual “auto-escalation” rate among all the states—an additional annual 1% increase in contribution until a maximum of 10% of an employee’s paycheck is invested in the savings plan. The states typically specify that employees may opt out of these auto-escalations and choose their own rates.

Employers’ only responsibility is to facilitate worker contributions into the automatic retirement accounts—a process similar to the payroll tax withholding that most employers already perform.

In most states, a board chaired by the state treasurer manages the program and determines which low-risk investments to participate in. The board also sets minimum and maximum employee contribution rates.

For more on the state auto-IRA plans, see Georgetown’s CRI 2019 report.

Voluntary state-run plans

Vermont offers a voluntary multiple-employer plan (or MEP) to help workers in small businesses save for retirement. Vermont is considering legislation to mandate an auto-enrollment program. Massachusetts is also considering a state-run auto-enrollment IRA plan.

New York has adopted a Roth IRA payroll deduction plan. Participation in New York’s Secure Choice Savings program is voluntary for both the small business and its employees. New Mexico’s legislature recently passed a state-run voluntary IRA plan, which awaits the governor’s approval.

Finally, Washington State administers a retirement “marketplace” to help consumers compare state-approved plans.

If you’re curious if your state offers—or is considering—any sort of retirement plan, check out Georgetown University’s interactive 2019 Legislative Action map outlining states’ efforts.

Savings options for the self-employed

By Ruth Susswein

Small business owners have to think outside the box when planning for an affordable retirement. Fortunately, there are a number of retirement savings opportunities for self-employed individuals.

IRAs

Traditional or Roth IRAs

Whether you’re on your own or have a few employees, each of you can open a traditional or Roth IRA (individual retirement account). These are retirement plans that owners and employees can contribute to and invest individually. You can deposit up to $6,000 a year—$7,000 if you’re age 50 or older. Traditional IRAs save you money up front by reducing your taxable income; Roth IRAs, funded with income you’ve already paid taxes on, offer tax-free withdrawals in the future.

Note: Roth IRAs offer flexibility that traditional IRAs do not in that they allow you to withdraw your contributions before retirement—for any reason—without penalty. However, earnings withdrawn from a Roth IRA before you are 59½ and have held the account for at least five years will be subject to taxes.

SIMPLE IRAs

Small business owners might also consider opening a SIMPLE (Savings Incentive Match Plan for Employees) IRA, which allows employees to participate in funding their own retirement accounts and requires the employer to contribute (a flat 2% of the employee’s salary) or match funds (up to 3% of salary). SIMPLE IRA contributions are limited annually to $13,500 per employee; $16,500 for those 50 and over.

SEP IRAs

For employers who are looking to save significantly more for themselves and employees, a SEP (Simplified Employee Pension) IRA is another option. Up to $57,000 in contributions can be made in 2020. Contributions can only be made by the employer, and the percentage contributed by the employer for him- or herself must be the same as for each employee. So, if you save 10% of your compensation for retirement, you must also deposit 10% of your employees’ salaries in their SEP IRAs.

Solo 401(k)s

Those who are self-employed, with no employees, may set up a Solo 401(k). A self-employed 401(k) lets you sock away more retirement dollars than most IRAs, but requires a little more paperwork. You can deposit up to $57,000 in 2020 because you can “double contribute”—once as the employer and once as an employee. NerdWallet explains how here.

With a Solo 401(k), you choose whether to reduce your taxable income now or set up the plan as a Roth 401(k), which allows for tax-free withdrawals later in life.

NerdWallet offers sound advice on the various savings options for self-employed individuals, including tips on choosing an IRA provider.

Highs and lows of employer-sponsored plans

By Lauren Hall

More than a third of employers automatically enrolled new workers into their company's automatic retirement plans in the fourth quarter of 2019, setting a new record, according to USA Today. Savings rates are up as well: 34% of companies participating in auto-enrollment plans report employees saving 5% or more of their salary each pay period. This is a massive improvement from 10 years ago, when only 11.8% of employees were saving at these levels.

The traditional defined benefit pension plan was the most common type of employer-sponsored plan in the 1970s. Today, they are quite rare. According to the U.S. Bureau of Labor of Statistics (BLS), only 18% of private-sector workers had access to a pension in 2017.

Instead, defined contribution retirement plans, like 401(k)s, are the most prevalent. BLS says about 44% of private industry workers participated in employer-sponsored defined contribution plans. These plans provide tax and savings incentives for employees and employers who participate and contribute.

Auto-enrollment may well become the norm. However, these plans might not encourage employees to save enough. Boston College’s Center for Retirement Research says, “While auto-enrollment will increase saving for workers who would not have participated without it, those who would have participated on their own may end up saving less due to relatively low employer match rates and low default contribution rates.”

As with other employer-sponsored retirement plans, high costs are a barrier to employers becoming involved in auto-enrollment plans. According to Pew research, the top reasons among small employers for failing to offer an auto-enrollment plan were “high start-up costs and lack of administrative capacity.”

The truth is, it takes time and effort for an employer to establish a workplace retirement plan, which can prove to be a particularly high barrier for smaller businesses that may not have the money to hire the staff to administer it. Nonetheless, the Department of Labor (DOL) encourages employers to do so, and offers a guide to help small businesses operate an auto-enrollment retirement plan. The guide encompasses everything from understanding nondiscrimination clauses, to reporting requirements for government agencies, to disclosing plan information to participants, to distributing plan benefits.

Avoid these retirement savings pitfalls

By Alegra Howard

Common retirement planning mistakes could seriously throw off your savings plan. Here are some pitfalls to avoid and tips to help you retire without worry.

- Miscalculating essential expenses. While it’s always smart to budget for unexpected expenses in retirement (like “aging in place” home renovations, “boomerang kids,” and auto purchases and maintenance), look at your current budget and cross out the items you won't be spending money on when you stop working. Costs associated with commuting, work wardrobes and power lunches will decrease significantly, as well as the portion of income you've been putting toward retirement savings. You’ll also likely fall into a lower tax bracket once retired, decreasing your annual tax liability.

- Forgetting about inflation. To keep up with rising prices, experts recommend factoring in an inflation rate of 2% to 3% per year when calculating your retirement expenses.

- Underestimating your length of retirement. Setting aside enough money to cover retirement expenses through your mid-80s could leave you in financial ruin by the time you hit your 90s. Don’t be left scrambling to come up with five to 10 extra years of retirement income, or risk becoming a burden to loved ones.

- Needing health insurance before Medicare. If you retire before age 65 (when Medicare eligibility begins), your only health insurance option may be through the Affordable Care Act Marketplace, and it could be costly. Other options could include joining your employed spouse’s health insurance plan, or using COBRA to continue your current health insurance coverage for up to 18 months after you retire, but these, too, are likely to be expensive.

- Thinking Medicare covers everything. Medicare covers roughly 80% of retirement healthcare costs. If you need dental work, a hearing aid or long-term care, you'll pay out of pocket—unless you purchase supplemental insurance. Also consider the cost of monthly premiums, annual deductibles, copays for doctor visits, and prescription drug costs. It’s estimated that healthcare expenses alone could reach more than $280,000 for a couple in retirement—don’t forget to consider these expenses in your budget. If you have a high-eductible health plan during your working years, and you contribute to a companion health savings account (HSA), you could allow those funds to accumulate for use in retirement. Earnings in your HSA aren’t taxable if used to pay for qualified medical expenses. The accounts are portable (meaning you can take yours with you when you switch jobs), and there are no “use-it-or-lose-it” penalties, unlike flexible spending accounts.

- Not preparing for long-term assisted living care. Consider purchasing long-term care insurance before you turn 59, as the premiums (already expensive) jump after that. Also, understand the premium increases you face during retirement and make sure you can afford to pay them. (Medicaid does cover long-term care for people without assets. Learn more here.)

- Changing jobs or retiring before vesting. Consider whether the employer contributions to your 401(k) plan or your stock options are fully vested (meaning that you have full ownership of the matched funds or the stock grants). Being vested usually requires that you’ve been employed for a specified period of time. Understand your vesting situation before switching jobs, or you may leave money on the table. Learn more about vesting.

- Losing track of fees. The fees and costs associated with maintaining your investment accounts might not seem significant when you first open the accounts, but they add up over the decades. Keep an eye on “assets under management”-based fees—a fee of even 1% of your portfolio’s assets could be significant as your investments grow.

- Forgetting about tax penalties. Don't withdraw funds from your individual retirement account or 401(k) plan until at least age 59½ or you may be subject to a 10% IRS penalty—plus federal and state income tax on the withdrawal. Don’t forget the 60-day rule: If you take money out of an IRA to roll it over to another qualified retirement account, you have 60 days to do so before taxes and penalties kick in.

- Taking Social Security benefits too early. The longer you wait to receive Social Security benefits, the higher your payout will be. While full retirement occurs at 66 or 67, if you can hold off, you’ll receive the maximum benefit at age 70. (Read more about delaying Social Security benefits.)

- Not budgeting for travel. It’s not only vacations you’ll want to plan for while you’re still mobile enough to enjoy them, but consider the costs associated with family obligations in the future. You won’t want to miss holidays, family reunions, weddings, the births of grandchildren and great-grandchildren, or college graduations, but these travel costs (flights, hotels and meals) can add up. Don’t forget to take advantage of senior travel discounts when available.

- Divorcing 'gray'. Divorce among couples aged 50+ has doubled since the 1990s. A divorce as you are approaching retirement means dividing assets, income and savings, without necessarily seeing a 50% decrease in expenses. When recalculating retirement savings as a single, don’t forget things like a change in tax rate or alimony payments (if any). If you’re still working and contributing to a retirement plan but aren’t already making catch-up contributions to IRAs and 401(k)s, consider starting if you will need to recoup retirement dollars lost in a divorce settlement.

About Consumer Action

[Staff] [Annual Reports] [How to Donate]

Consumer Action is a non-profit 501(c)(3) organization that has championed the rights of underrepresented consumers nationwide since 1971. Throughout its history, the organization has dedicated its resources to promoting financial and consumer literacy and advocating for consumer rights in both the media and before lawmakers to promote economic justice for all. With the resources and infrastructure to reach millions of consumers, Consumer Action is one of the most recognized, effective and trusted consumer organizations in the nation.

Consumer education. To empower consumers to assert their rights in the marketplace, Consumer Action provides a range of educational resources. The organization’s extensive library of free publications offers in-depth information on many topics related to personal money management, housing, insurance and privacy, while its hotline provides non-legal advice and referrals. At Consumer-Action.org, visitors have instant access to important consumer news, downloadable materials, an online “help desk,” the Take Action advocacy database and nine topic-specific subsites. Consumer Action also publishes unbiased surveys of financial and consumer services that expose excessive prices and anti-consumer practices to help consumers make informed buying choices and elicit change from big business.

Community outreach. With a special focus on serving low- and moderate-income and limited-English-speaking consumers, Consumer Action maintains strong ties to a national network of nearly 7,000 community-based organizations. Outreach services include training and bulk mailings of financial and consumer education materials in many languages, including English, Spanish, Chinese, Korean and Vietnamese. Consumer Action’s network is the largest and most diverse of its kind.

Advocacy. Consumer Action is deeply committed to ensuring that underrepresented consumers are represented in the national media and in front of lawmakers. The organization promotes pro-consumer policy, regulation and legislation by taking positions on dozens of bills at the state and national levels and submitting comments and testimony on a host of consumer protection issues. Additionally, its diverse staff provides the media with expert commentary on key consumer issues supported by solid data and victim testimony.

Downloads

Saving for retirement (Spring 2020) (CANews-Retirement_Savings_2020.pdf)

Quick Menu

Support Consumer Action

Join Our Email List

Housing Menu

Help Desk

- Help Desk

- Submit Your Complaints

- Frequently Asked Questions

- Links to Consumer Resources

- Consumer Services Guide (CSG)

- Alerts